In today’s fast-paced world, managing finances and earning rewards efficiently is a game-changer. Enter the new One Key™ Cards and OneKeyCash™, a revolutionary rewards program designed to simplify and enhance your financial journey. This review delves into the features, benefits, and overall experience of using One Key™ Cards and earning OneKeyCash™.

Table of Contents

- Introduction

- What is One Key™?

- How One Key™ Cards Work

- Earning OneKeyCash™

- Key Benefits of One Key™ Cards

- User Experience

- Comparing One Key™ Cards to Other Rewards Programs

- Frequently Asked Questions (FAQ)

- Pros and Cons

- Conclusion

Introduction

The landscape of financial rewards programs is ever-evolving, with new players constantly emerging. One Key™ Cards and OneKeyCash™ are the latest entrants, promising a seamless and rewarding experience. This review aims to provide a thorough understanding of what these offerings entail and how they can benefit you.

What is One Key™?

One Key™ is a unified rewards program that integrates various financial services into a single, user-friendly platform. By combining payment methods with rewards earning potential, One Key™ aims to streamline the way you manage your finances and reap benefits.

How One Key™ Cards Work

One Key™ Cards are designed to function as both a payment method and a rewards card. Here’s a breakdown of how they operate:

- Application Process: Applying for a One Key™ Card is straightforward. You can apply online, and upon approval, receive your card within a few days.

- Activation and Setup: Activating your card is simple, with step-by-step instructions provided. Once activated, you can link it to your existing bank accounts or credit cards.

- Usage: Use your One Key™ Card for everyday purchases, online shopping, and bill payments. Each transaction earns you OneKeyCash™.

Earning OneKeyCash™

OneKeyCash™ is the rewards currency of the One Key™ program. Here’s how you can earn it:

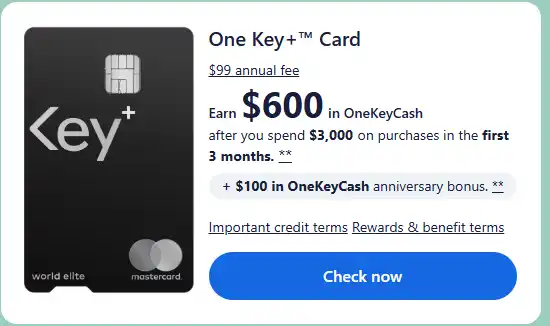

- Daily Purchases: Earn a percentage of OneKeyCash™ for every dollar spent using your One Key™ Card.

- Special Promotions: Take advantage of promotional offers that provide bonus OneKeyCash™ for specific purchases or during certain periods.

- Referral Program: Refer friends and family to One Key™ and earn additional OneKeyCash™ when they sign up and start using their cards.

Key Benefits of One Key™ Cards

The One Key™ Cards offer a plethora of benefits designed to enhance your financial well-being:

- Ease of Use: The integration of payment and rewards functions into one card simplifies your financial management.

- Generous Rewards: Competitive earning rates for OneKeyCash™ make it easy to accumulate rewards quickly.

- Flexibility: Redeem OneKeyCash™ for a variety of options, including travel, gift cards, and statement credits.

- Security: Advanced security features ensure your transactions and personal information are protected.

- Customer Support: Access to 24/7 customer support for any issues or questions regarding your card or rewards.

User Experience

Users of One Key™ Cards consistently report a positive experience, highlighting the convenience and rewards potential as standout features. The user-friendly app interface allows for easy tracking of transactions and rewards, making financial management a breeze.

Comparing One Key™ Cards to Other Rewards Programs

When compared to other rewards programs, One Key™ Cards stand out due to their high earning potential and seamless integration of payment and rewards functions. Unlike some programs that require juggling multiple cards and accounts, One Key™ simplifies the process, making it an attractive option for busy individuals.

Frequently Asked Questions (FAQ)

Q1: How do I redeem my OneKeyCash™? A1: You can redeem OneKeyCash™ through the One Key™ app or website for various options like travel, gift cards, or statement credits.

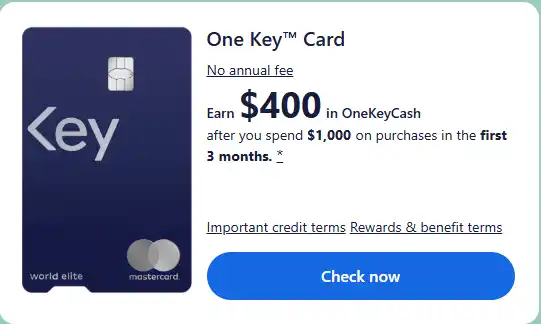

Q2: Are there any annual fees for the One Key™ Card? A2: The annual fee structure varies by card type. Some cards offer no annual fees, while premium cards may have associated fees.

Q3: Can I link my One Key™ Card to multiple bank accounts? A3: Yes, you can link your One Key™ Card to multiple bank accounts for added convenience.

Q4: How secure is the One Key™ Card? A4: One Key™ Cards come with advanced security features, including fraud protection and secure transaction protocols.

Pros and Cons

Pros:

- High earning potential for rewards

- User-friendly app and website

- Flexible redemption options

- Strong security features

- Excellent customer support

Cons:

- Potential annual fees on premium cards

- Limited to users who qualify based on credit score

Conclusion

Unlocking the Future of Financial Rewards

In conclusion, the One Key™ Cards and OneKeyCash™ rewards program offer a compelling combination of convenience, rewards, and security. For those looking to streamline their financial management while earning valuable rewards, One Key™ presents a promising solution. With its user-friendly interface, flexible redemption options, and robust security measures, One Key™ is poised to become a leader in the financial rewards space. Whether you’re a frequent traveler, an avid shopper, or someone who values simplicity in financial management, the One Key™ Cards and OneKeyCash™ rewards program are worth considering.

4o